Hi everyone,

Some of you have asked us about what expenses have changed since last year. On the whole, we left most of our expense-related guidelines intact; the only major change was switching from automatic approval of event travel to request-based travel. We also added clarifying information to our policies where we felt the existing wording was too ambiguous to be helpful. We’ve added links to all the related policies in this post.

We’re still asking people to post on Discuss when making travel plans - we felt overall this is beneficial as it gives more transparency and equity to travel-related expenditure, and helps ensure decisions about travel are applied consistently (giving everyone at Status a chance to pitch in with their opinions).

In general, we’re here to reimburse you for all reasonable work-related expenses. Given the current financial position, we’d appreciate everyone’s diligence when it comes to spending.

Here is a comprehensive list of everything that is allowed and not allowed:

| Non-Reimbursable Expenses Travel | Reimbursable business Expenses Travel |

|---|---|

| Airline club dues | Airfares |

| Airline seat upgrades (extra legroom) | Airport parking (where reasonable) |

| Airport/immigration fast-pass or trusted traveler programs | Car rental - Only if approved beforehand |

| Airline/hotel cancellation/rebooking fees | Hotel / Airbnb accommodation |

| Babysitter and other child care costs | In-flight WiFi (for business use) |

| Additional + Excess Baggage | Laundry charges for trips longer than 5 days |

| Cash and cash equivalents (e.g. gift cards, gift certs, gift vouchers) | Meals: up to 75 USD per day including tips. (For the tip amount follow local custom) |

| Charitable donations | Expedited service fees, travel visa, inoculation fees necessary for the destination, additional passport (only to facilitate business travel to countries where you can’t use your original passport) |

| Cosmetics (lipstick, make-up remover, etc.) | Taxis or rail journeys during trip |

| Credit card delinquency charges or interest expense | Travel insurance |

| Discount passes/cards (e.g. German BahnCard, Japan IC card) | |

| Fees for use of facilities such as gyms, health clubs, saunas, spa treatments etc. | |

| Frequent flyer miles used to buy airline tickets | |

| Hotel in-room movies/entertainment | |

| Hotel no-show charges | |

| In-flight movies/entertainment | |

| Items for personal comfort (earplugs, earmuffs, eye mask, etc.) | |

| Large bar tabs (unless permission before for an event/meet-up) | |

| Medicines/vitamins | |

| Mobile fees (roaming & sim cards) | |

| Personal costs (e.g. family or spousal travel) | |

| Personal car repairs, maintenance, or insurance | |

| Personal gifts (e.g. for occasions such as birthdays, holidays, weddings, baby showers, promotions, leaving the company, retirement, etc.) - speak to People Ops if you’d like to do something special for a fellow team member, they’ll be happy to guide you on options | |

| Personal grooming (barber/hair stylist, shoe shining, etc.) | |

| Personal toiletries (shampoo, sanitary pads, soap, etc.) | |

| Pet-related costs | |

| Electric plug convertors | |

| Traffic fines, customs charges, or similar | |

| Vendor and contractor costs, including gifts or rewards | |

| Any costs associated with regular commute to office | |

| Please see handbook guide for travel expenses here. |

What’s changed on the travel expenses policy since 2018?: Nothing - we are simply building out the list of expenses for additional clarity.

| Reimbursable Expenses Devices | Non-Reimbursable Expenses Devices |

|---|---|

| One Laptop is reimbursable up to a maximum value of EUR 2000 or equivalent local currency. Please discuss with People Ops before purchasing | Additional chargers, plugs, adapters, cords |

| Phones are reimbursable up to a maximum value of EUR 800 or equivalent local currency. (we ask that you only buy a phone if there’s a business use for it in your role. Please discuss with PeopleOps before purchasing) | Printers |

| One LedgerNano per contributor | Monitors |

| One YubiKey per contributor | Computer Keyboard |

| Computer mice | |

| Personal software subscriptions (unless it’s required to do your job) - if you’re looking for team-based license subscriptions, please check with finance, as this will come out of your team budget | |

| Computer repairs caused by personal damage | |

| Please see handbook guide for devices here. |

What’s changed on the devices expenses policy since 2018?: We’re asking that phones are only purchased where there’s a work requirement to have one, versus being automatically approved.

| Reimbursable Coworking | Non-Reimbursable Coworking |

|---|---|

| 250 Eur per month: coworking space rental / hotdesk / access pass or Coffees at coffee shops where you use the wifi | Home Wifi |

| Portable wifi devices | |

| Fees for mobile phone usage for Wifi | |

| Please see handbook guide for Coworking here |

What’s changed in the coworking expenses policy since 2018?: Nothing, we considered removing coffee shop receipts as valid expenses due to the additional accounting burden, but decided to keep them as they were useful for some contributors to maintain a healthy working balance. We hope that by asking people to group receipts up to a minimum EUR 50, this will help offset the administrative tax on maintaining this expense type.

Important things to remember before submitting a report:

*We currently reimburse expenses together with payroll, so try to submit your reports by the 20th of each month. If you miss that date, you will have to wait until the next pay cycle.

DE| CH Employees: Must submit expenses by the 15th of each month.

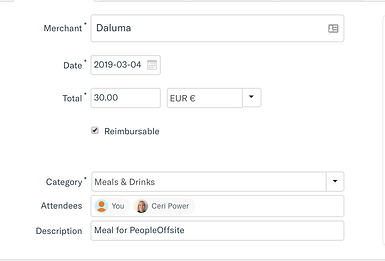

- All expenses must have a comment. If another contributor is with you, please don’t forget to tag them in the expense.

- Example (two contributors have had a meal together, only one person needs to submit the expense and can tag the other):

- Example:

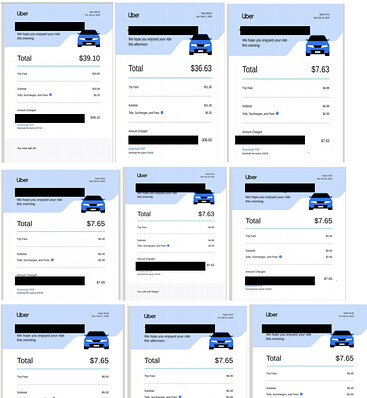

- Please group all the small expenses under 50 Euro together to create on larger expense. Each single expense creates a new line item that needs to be manually copy pasted for our accounting purposes. By grouping smaller purchases into one larger expense, you’re helping us keep our administration streamlined. Note that it needs to be one consolidated expense rather than report (each expense item within a report is still its own line item in our accounting records).

- Example (a person has taken several Ubers, and added up the total value into one expense item):

- Example (a person has taken several Ubers, and added up the total value into one expense item):

Please let me know if you have any questions. ![]()