tldr: Increasing growth and retention is going to be hard, but we are in a good position to do it if we work towards the same goal. Here is what we need to do. This is a log of our journey.

This thread serves as a log for our user growth rate and retention rate. The goal is to paint the target red daily or weekly. This can then be used to fork out into specific initiatives.

The first priority is getting clarity on our metrics. We need to know our growth rate and our retention rate to be able to improve them. Without this we are basically flying blind.

Metrics

The simplest way to measure this is with these two metrics:

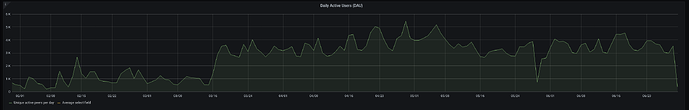

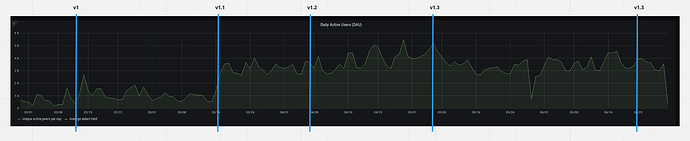

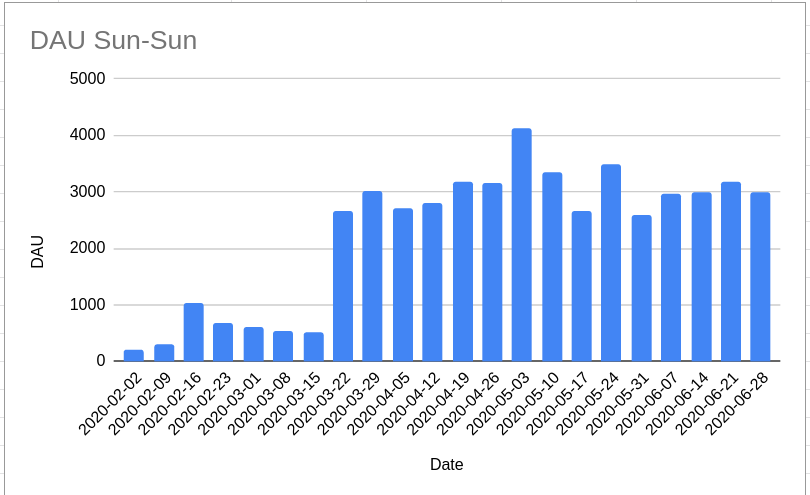

- User growth: DAU over time

- Stickiness: DAU / MAU

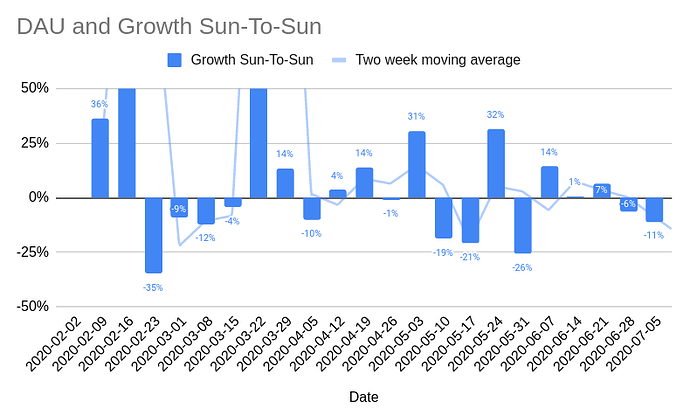

User growth

DAU stands for Daily Active Users. This matters because it is a very good proxy for “revenue” in the network, as this is likely a constant with number of users as a multiplier.

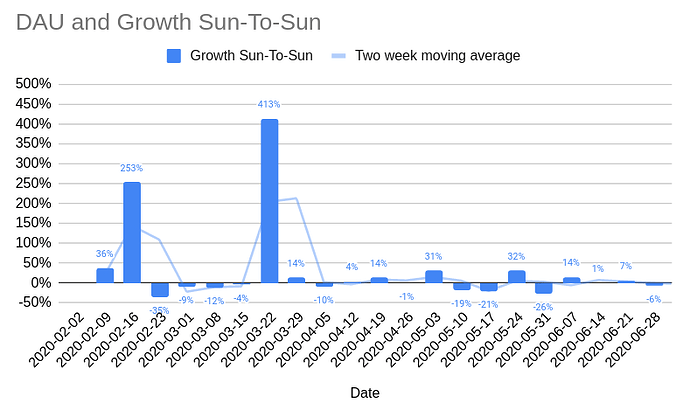

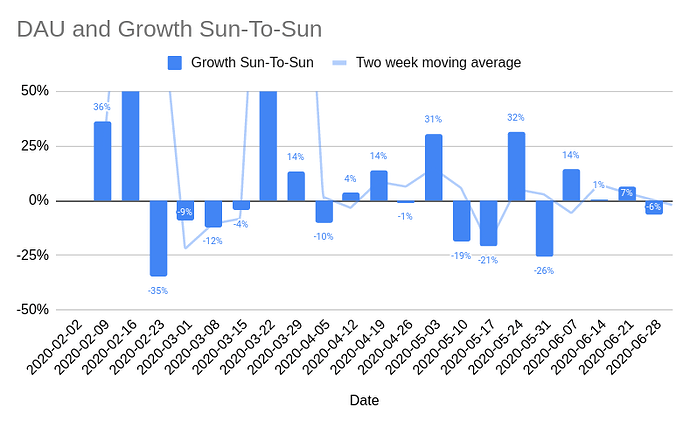

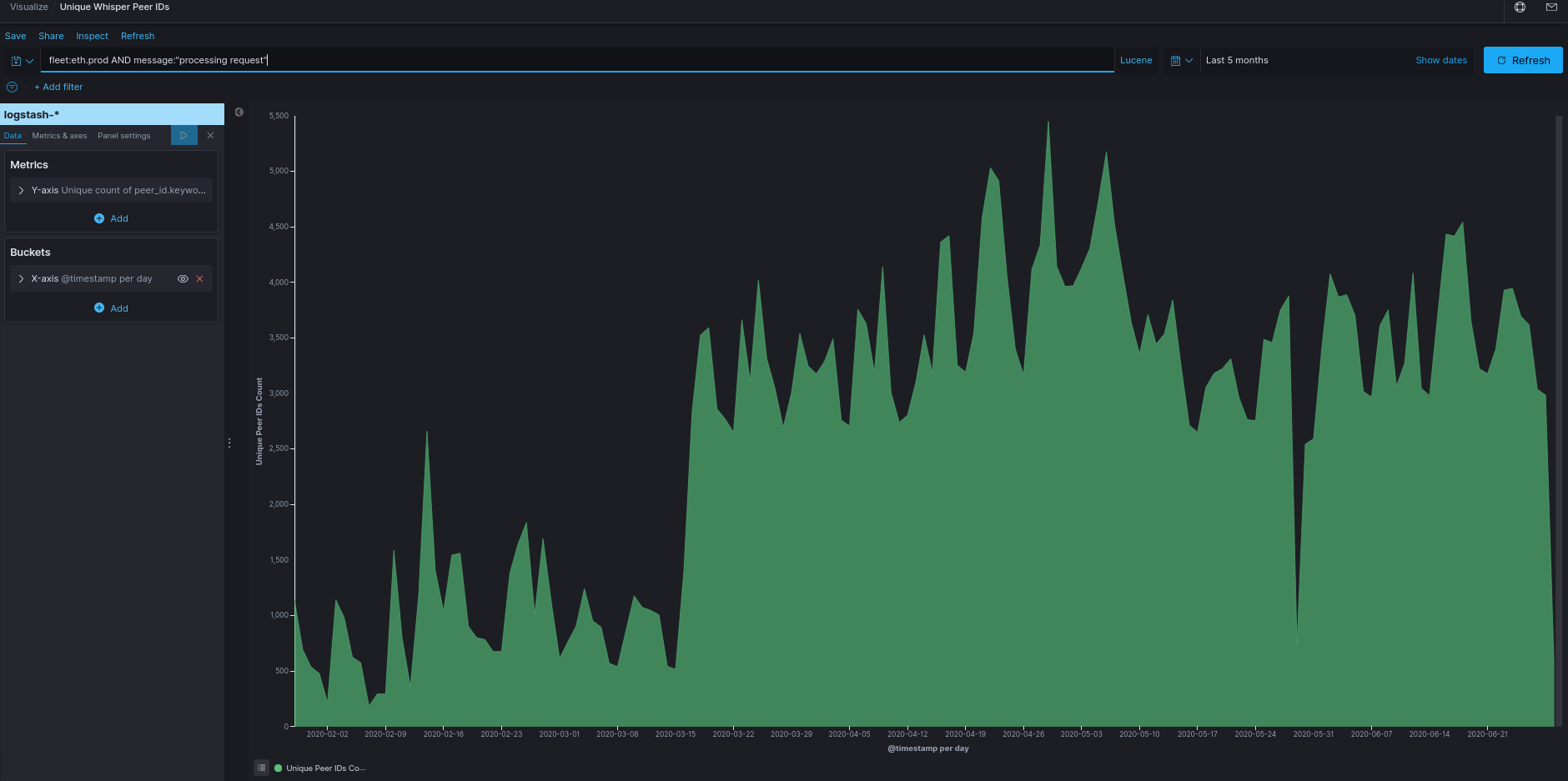

In our case, DAU means some unique peer that is active in the network. We want to see DAU grow significantly on a weekly basis. For example, growing 20% week over week leads to ~10x users in three months. We have some cheat codes here, with the user acquisition strategy and an excellent performance marketing team.

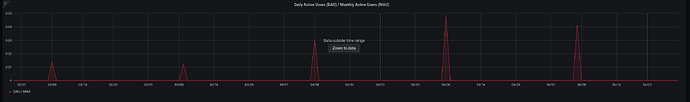

Stickiness / Retention rate

MAU stands for Monthly Active Users. By dividing DAU with MAU you get a stickiness. This measures how “sticky” the product is and how well we have achieved product-market fit. Acquiring a new user is also significantly more expensive than retaining a old user. Stickiness isn’t exactly the same as retention rate, but it’s close.

For example, 50% would mean half of users active in a month are also active every day. This would be excellent. By contrast, 1% would be very poor. Where it lands in between depends on how good the product is and how people use it in their lives. Used as a messaging app, as opposed to a bank, we’d expect this to be quite high.

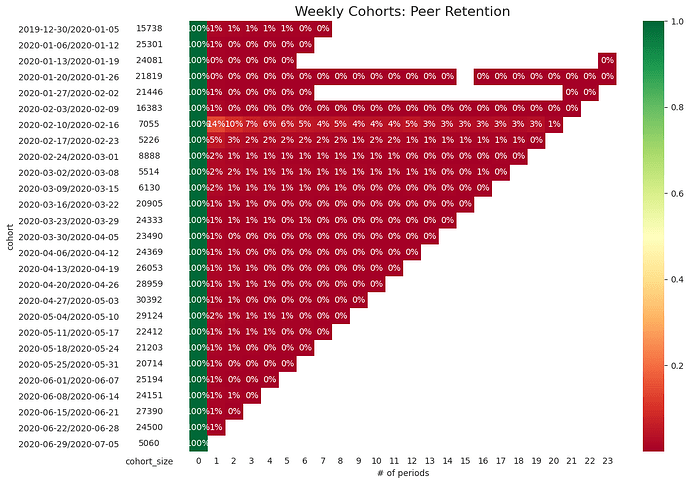

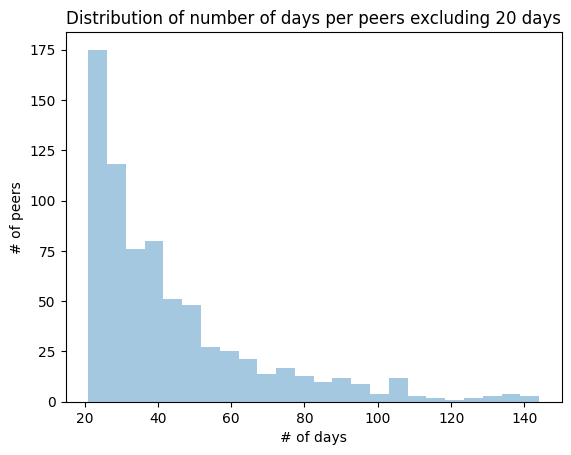

There are more complex forms of tracking retention such as retention curves, cohort analysis, etc but let’s start basic. Once we have those down, a good next step would be to get proper retention curves. This can then be segmented, for example by time/version, OS and market (tracking is difficult here though due to our focus on privacy, so likely we’d get quite coarse metrics here).

Current state

Metrics

Now, we should be able to go to https://analytics.status.im/ or http://metrics.status.im/ and see these two metrics clearly. As far as I can tell, that is currently not the case.

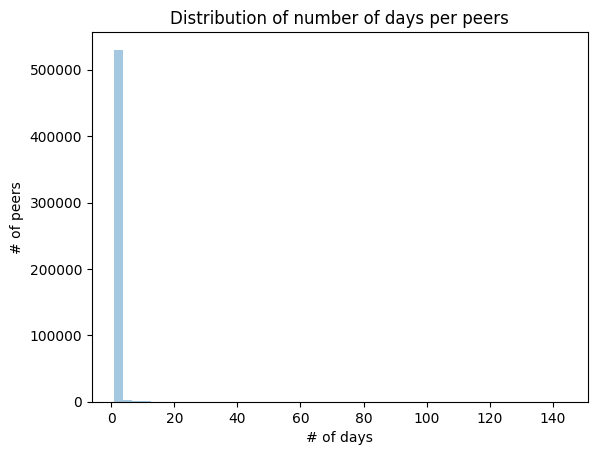

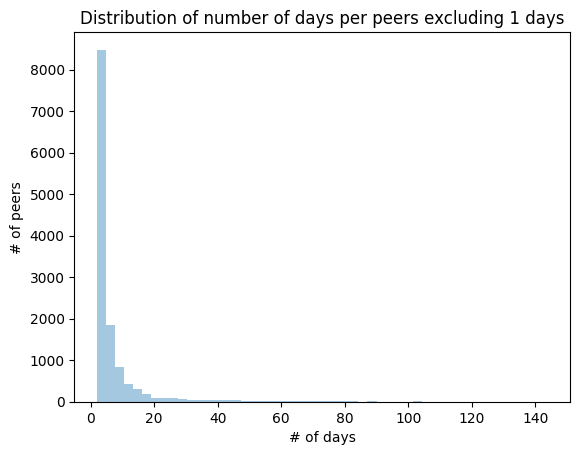

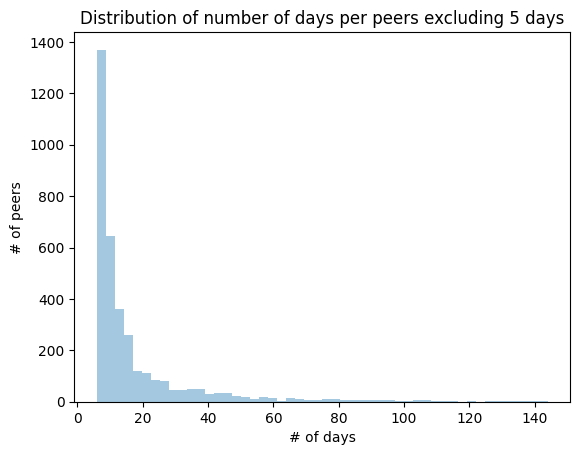

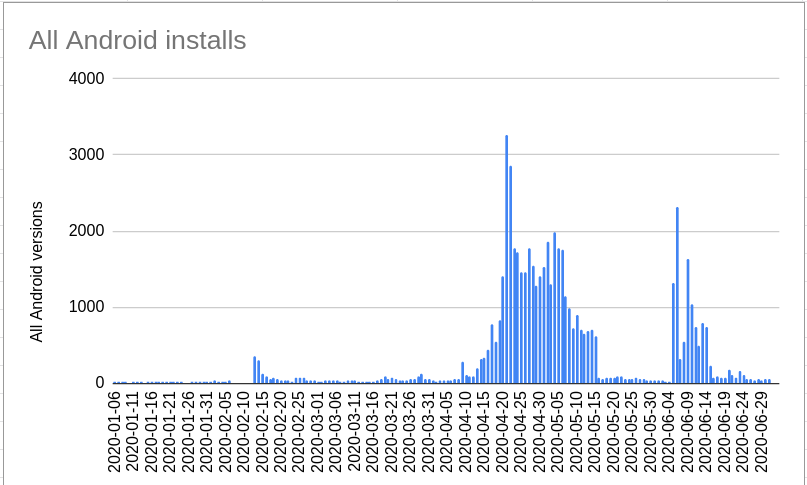

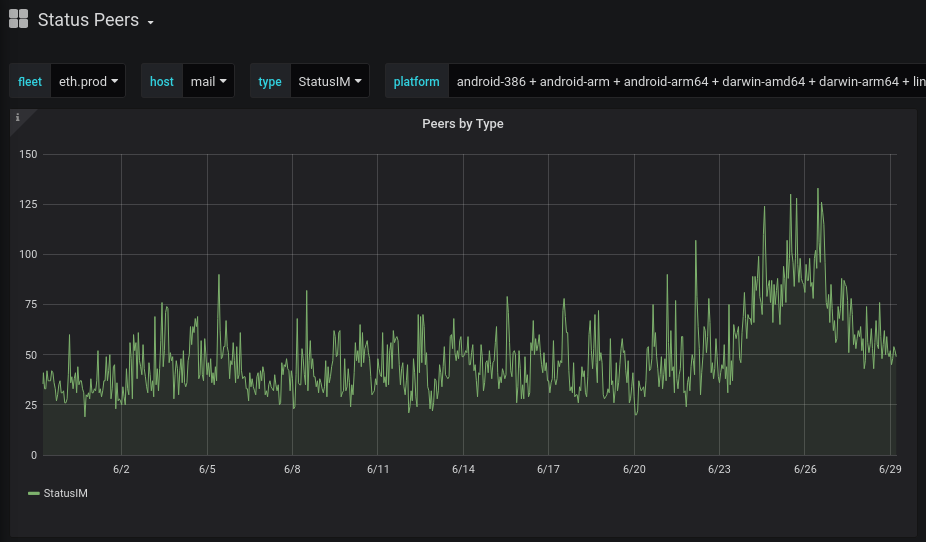

As an open p2p network with a focus on privacy, this is obviously a bit more involved. What do we have instead? We have a cluster which most nodes connect to. We can see the number of connections, and we can see the number of messages flowing through the system. As a decent proxy for DAU and MAU, we can use the number of unique peers (enodes) per day to our cluster. Ideally we’d also filter out things like bridges, end-to-end tests, etc.

When going to https://metrics.status.im I get redirected to https://metrics.status.im/d/gxQG_R1Zk/status-peers?orgId=1&refresh=15m. The first pane here seems to show the number of current peers connected, at around ~50. While useful and an indication of growth, it isn’t quite what we want.

We also have log data from Kibana which shows the “Unique Whisper Peer IDs”. Currently this is around ~3000. My understanding is that this is per day, but I don’t know for sure. If that is the case, this appears to be a reasonable proxy for DAU. This also includes bridges, end-to-end-tests, etc, which skews the result. It isn’t clear to me what the impact of this is, though it likely biases things like retention upwards (computers never get tired of running code).

It isn’t clear to me how to get MAU here, but I’m sure it is doable with some Kibana-fu.

There is also an issue here for creating retention graphs but it appears to not be prioritized right now: https://github.com/status-im/infra-hq/issues/17 (private repo).

Specific tasks

These metrics need to be crystal clear and visible under either https://metrics.status.im/ or https://analytics.status.im/. They should be understandable by a non-technical user for decision making.

We need to show these two metrics DAU and DAU/MAU in clear graphs.

It also needs to be clear what the methodology is for collecting these metrics are. For example, what impact does end-to-end-tests and bots etc have? Ideally these are filtered out, but a caveat with some reasoned arguments would be useful.

I would expect Core and Infra to lead this implementation work. cc @andre @jakubgs

Growth - product, community and marketing

While clarity is being developed on the technology side, we need to make these numbers go up. It seems quite clear what the performance marketing team is doing here, in terms of plan for user acquisition, etc.

For the product itself, a lot of work has gone into making the app more user friendly. The app is in way better shape now than it was 3m ago, and infinitely better than a year ago. What is missing, and perhaps this is documented somewhere already, is a working theory for increasing retention. The biggest tell tale for this not existing is that we don’t have any form of retention metrics setup, so we are essentially flying blind as to the impact of our work. If we were dogfooding the app as an organization, that’d be one signal, but right now we are barely doing that.

What I’d like to see here is an idea of doing X work leading to Y increase in retention. That way we can try things out, and focus on small wins, as opposed to costly dev efforts. Obviously, this will be quite coarse and delayed data due to our privacy focus. E.g. version release + 1w. The point is to have an actual theory, that is backed up by something (intuition, similar apps, user interviews, etc) and can be tested to some extent. Not to have perfect metrics and tractability for everything.

For example, getting a user to add their first 5 friends seems and actively benefiting from using the app as quickly as possible seems like very useful tasks that don’t require too much dev effort.

I’d like to see such a working theory being presented, and that we make sure that we measure work done by this standard.

On the community side, it seems like a high ROI activity to me to have ambassadors (e.g.) welcome users, make them feel at home and ask them questions. For example, #status is often a cesspool and this is a probably a turn-off for new users.

Another element here is how user acquisition works different in different markets. For example, in LatAm perhaps they are more interested in using Status as a “bank”, as opposed to as a messenger. This would also impact how we measure DAU and what stickiness would look like.

Specific tasks

I’ll largely leave this to Core, Product, Design, Community and Marketing, as I’m probably ignorant of a lot of efforts in this area.

I would like to see a working theory for increasing retention though. The working theory for increasing growth seems quite sophisticated to me in terms of performance marketing.

In this thread I’d also love to see specific ideas and efforts that people are working on to increase growth and retention.

References

Status Base Model (private)

https://colab.research.google.com/drive/11-KqAG4nDcLXMY5acyTyuHHzrl3yd-MG#scrollTo=5cXY40JLe43Q

Startup = Growth (Paul Graham)

http://paulgraham.com/growth.html

Lecture 6 Growth (Alex Schultz)

https://startupclass.samaltman.com/courses/lec06/

Let’s go!

This thread is a living log, so anything related to measuring or improving growth and retention goes ![]()